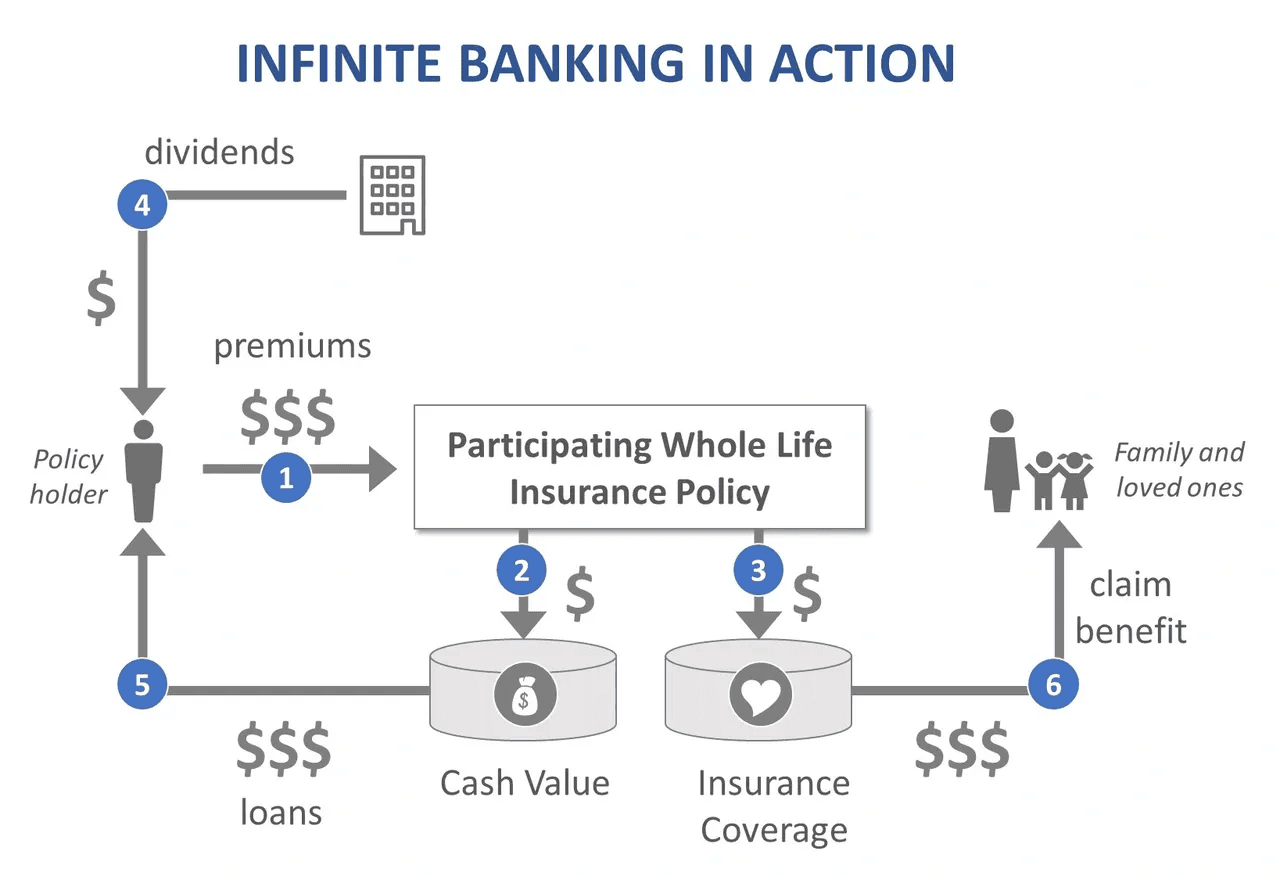

The Infinite Banking strategy is a transformative approach for individuals looking to escape debt and build wealth. It revolves around a common cycle: we trade our time for money, desire things that are often beyond our immediate budget, and end up borrowing from banks. Unfortunately, the traditional interest structures frequently trap people in a cycle of endless debt, where principal balances remain largely untouched.

This is where the Infinite Banking whole life policy comes into play, especially one from a mutual company that pays dividends. By directing your income into this policy, you create an interest-bearing account with annual compounding benefits. The key advantage is that you can borrow against this account to pay off debts while still earning interest on your principal. This strategic approach allows you to use your own money effectively, freeing you from the burden of compound interest charged by traditional banks.

By implementing this strategy annually and compounding the dividends earned, you can gradually eliminate debt. Essentially, you create your own banking system, enabling you to purchase cars, homes, and other assets using your funds and paying only simple interest. This method offers a refreshing alternative to the compound interest traps set by conventional banks, paving the way for financial independence and allowing you to utilize your money more strategically.

Sam Vadakekut

Strategic Wealth Advisor

Optimal Wealth Strategy Group

optimalwealthstrategygroup.com

optimalwealthsg.com